The term “short-arm margin” may sound simple, but it is the number one of the most misunderstood terms in the area of mortgage lending. On one hand, a borrower is interested in the headline interest rate as a primary focus while, on the other hand, a lender is the one who is looking at the margin percentage rate that can be found inside the adjustable rate mortgage structures. The space between both of them serves as a direction where the profit, risk, and expectation often differentiate, hence causing a misunderstanding. Finding out where is the real profit and where is the fuss is about recognizing the working of ARM margin and its interaction with the index rate as important aspects that should be more known about ARMs than borrowers want to give them credit for.

At this stage, most borrowers concentrate on visible mortgage costs rather than the mechanics behind how those costs are calculated.

How an Adjustable Rate Mortgage Works

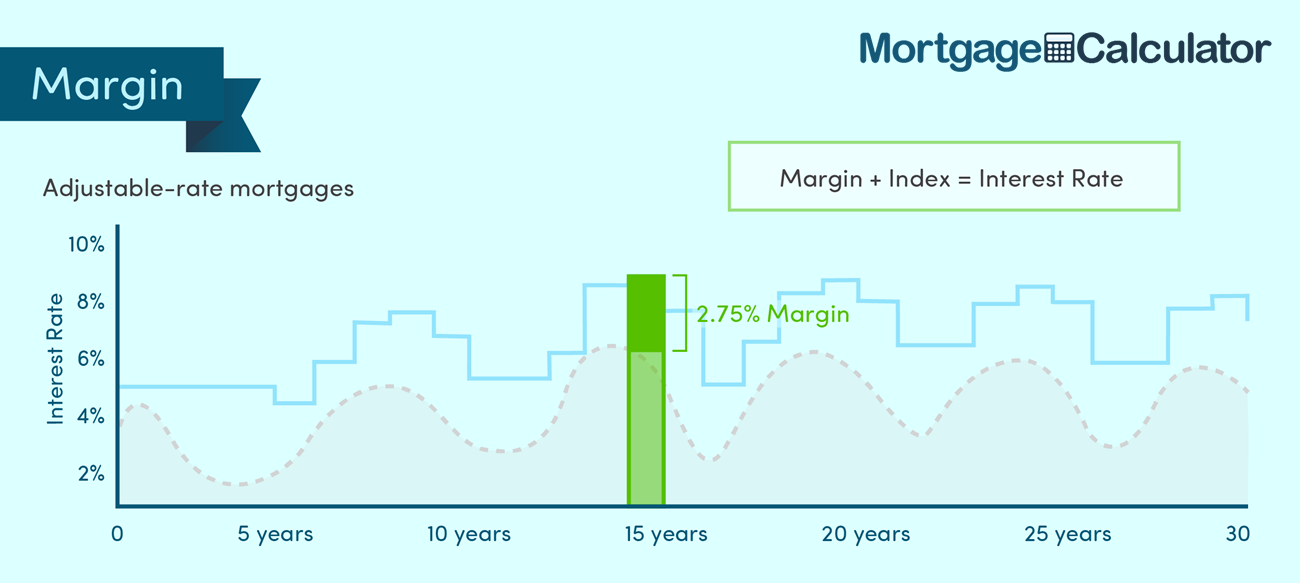

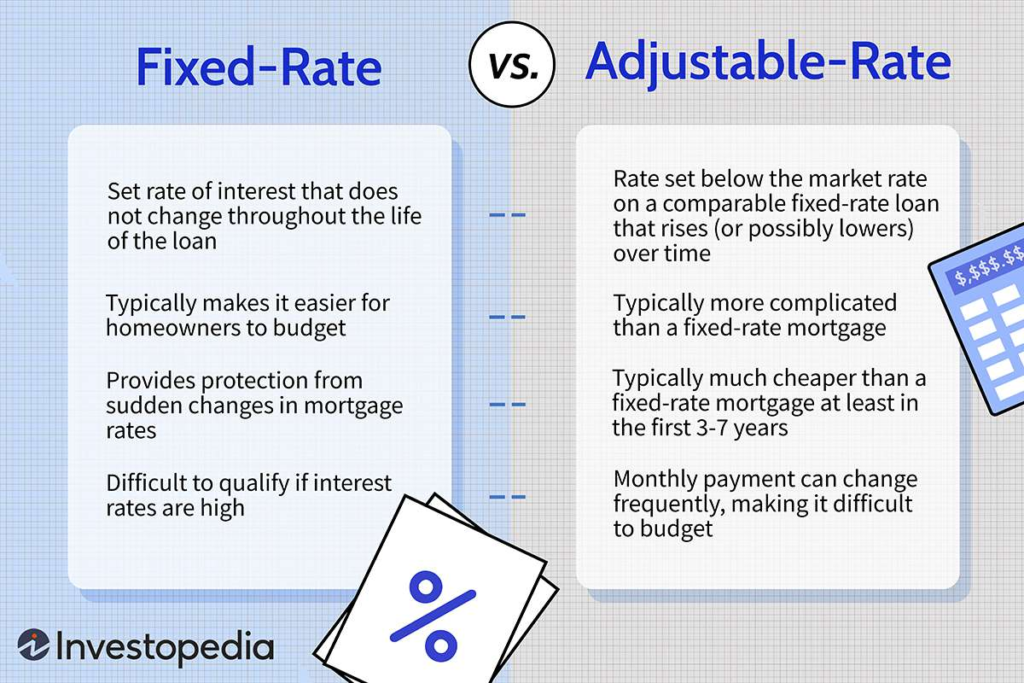

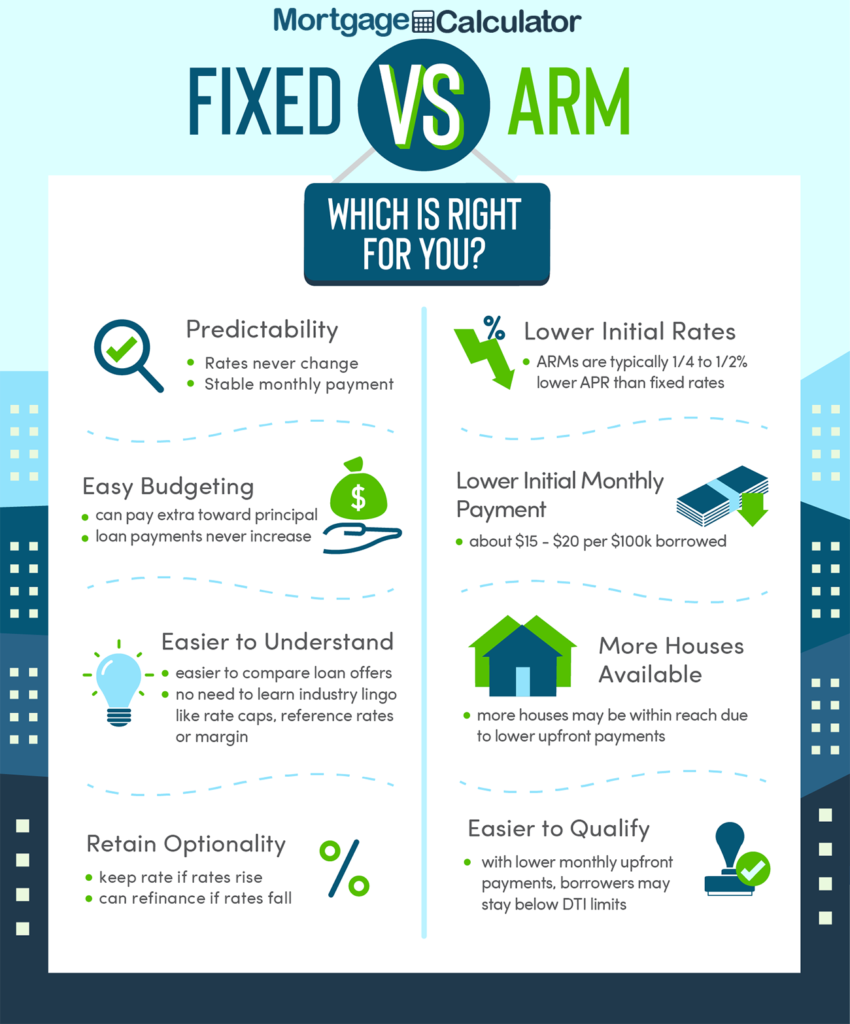

Basically, an ARM is a type of loan with a variable interest rate that is determined by a benchmark rate. In contrast to fixed-rate loans, where the interest rate stays the same, an ARM is based on a variable rate mechanism. A variable rate is one that is made up of two parts:

- the index rate

- the margin

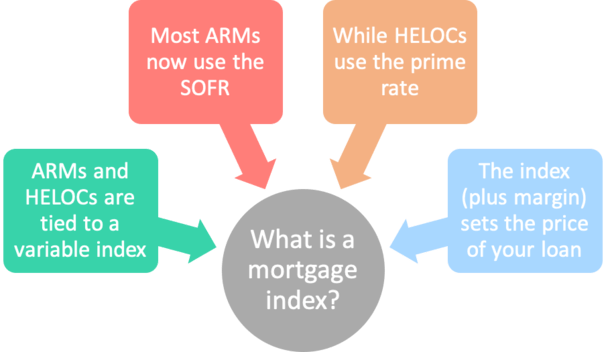

The index represents the broader market, while the margin is a fixed percentage which is determined by the lender. All together they create the fully indexed interest rate that is the one that will be paid by the borrower after the first fixed period ends.

This benchmark component is often referred to as the indexed rate in loan documentation.

What Short-ARM Margin Means

Short-arm margin is a term used to explain the marginal factor in ARMs with shorter fixed periods, like:

- 3/1 ARMs

- 5/1 ARMs

- hybrid ARMs

This type of loan is popular because it usually starts with an interest rate lower than that of the conventional fixed mortgage. However, the password to understanding is simple: the less time fixed-rate loans offer, the sooner they can be adjusted, which in fact, exposes both parties to the consequences of the index rate. The ability to turn this into a topic of both profit and argument is precisely what this exposure is about.

In short-arm structures, the base interest rate is temporary and designed to transition quickly.

Lender Perspective on ARM Margin

When it comes to the lenders, the ARM margin is thought of as a linear source of money. The index rate may go or decrease depending on the lending market conditions, the central bank’s decision, and the economy, but the margin will remain stable through the loan’s duration. The margin is basically the number that reduces the lender’s credit risk, operating investment outlay, and capital cost. The margin is seen as a core structural element and is not a variable; it does not change.

This fixed component exists to cover operating expenses and protect long-term profitability.

Borrower Perspective on ARM Margin

On the other hand, the margin can be invisible for the borrowers. In the early stages of the loan, during the initial fixed phase, people mainly focus on the low starting interest rate that ultimately attracts them to the plan. This rate almost always covers the bigger picture of how much of the loan that has not yet been adjusted will be determined by the margin itself. Later on, the rates change, and the borrower needs to pay the index rate together with the margin, irrespective of whether the market is good or bad at the time.

At that point, the borrower pays both the market-driven component and the lender’s fixed markup.

How the ARM Interest Rate Is Formed

| Component | Description |

| Index rate | Represents the broader market and changes over time |

| Margin | Fixed percentage determined by the lender |

| Fully indexed interest rate | Index rate + margin, paid after the fixed period |

Where the Fuss Comes From

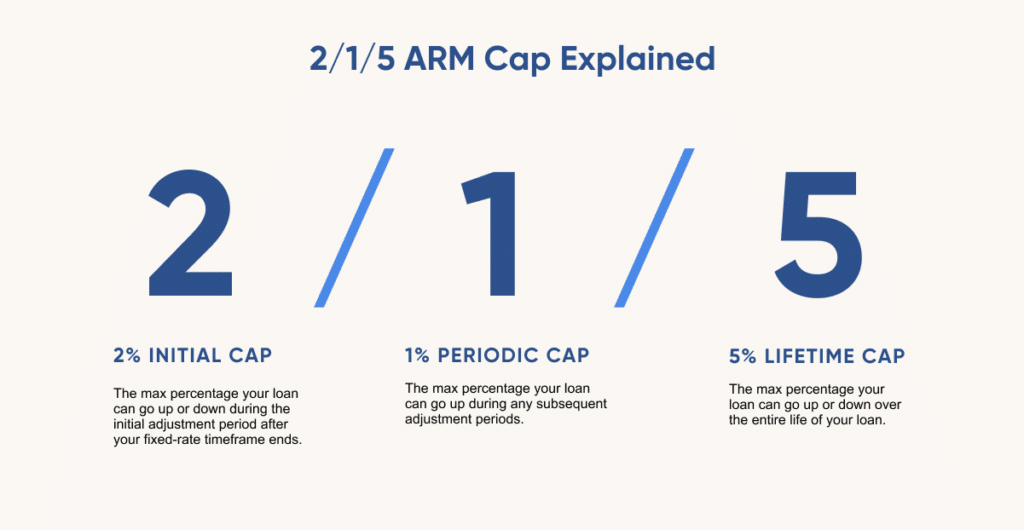

The fuss about the short-arm margin comes precisely from the visibility of that margin being delayed, for borrowers it may come to a point when they do not see how big their commitment will be in the long run due to renegotiation of a margin that they cannot change. Conversely, lenders behave in a specific way to ensure a profit that the first reset window offered them. In fact, that period of the shorter loan means they are able to change the interest rate on the loans with higher speed, thus, the lender is exposed to market risks to a higher degree.

Margin Differences and Risk Profiles

In the lending business, margins vary based on borrower identity and perceived risk. A borrower that boasts a high credit score and a good amount of equity may get a lower margin, while a higher risk profile usually carries the burden of a higher margin. Even a minor difference in margin could make a huge difference afterwards, especially if it is combined with the already rising index rates.

These differences directly affect long-term loan interest accumulation.

How the Fully Indexed Interest Rate Is Calculated

To see how the fully indexed interest rate is determined it is easy to visualize it as a simple equation. It is not just a choice or a matter of discretion. Instead, it is determined by:

- the existing index rate

- the margin stated in the loan agreement

So, when the index rate dramatically spikes up, the buyer pays out more, even though the margin stays the same. When the index rate falls, the buyer’s payment also decreases, subject to rate floors embedded in the loan structure. The lender still profits from the deal because of the margin.

Borrower vs Lender Exposure in Short-ARM Structures

| Aspect | Borrower | Lender |

| Exposure to index rate | High | Indirect |

| Margin flexibility | None | Fixed and predictable |

| Payment volatility | Yes | No |

| Revenue stability | No | Yes |

Hybrid ARMs and Margin Timing

The short-arm margin has a special place in hybrid ARMs. They are the course of the fixed-rate structure first and then the variable comes into play. The adjustable-rate mortgage (ARM) products, which are of hybrid type, are dependent upon a fixed interest rate for a short duration, followed by a floating or variable rate. In other words, there is no active margin while the buyer is exposed to the promotional rate of the product. The truly adjustable margin will be shown only after the loan is recalculated.

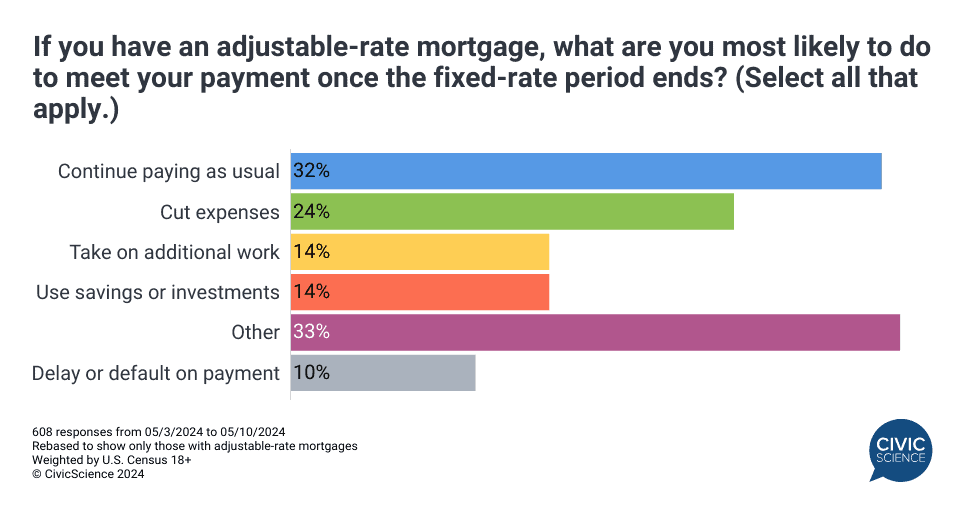

Where Borrower Frustration Appears

At this point, frustration often appears. Many loan debtors assume that payment increases are caused only by rising interest rates, without realizing that they are paying:

- the base interest reflected in the index rate

- the lender’s fixed markup through the margin

FAQ — Short-ARM Margin Explained

What makes margin a profit structure in ARM loans?

Margin as a Profit Structure

If seen from the perspective of profitability, the margin is one of the most reliable revenue sources from an ARM loan. Even though the lenders may face funding cost fluctuations and market instability, the margin acts as a buffer. It is meant to cover costs, contribute to net margin, and ensure profitability even when the index rate is dynamic.

How does market volatility affect borrower perception?

Market Volatility and Borrower Perception

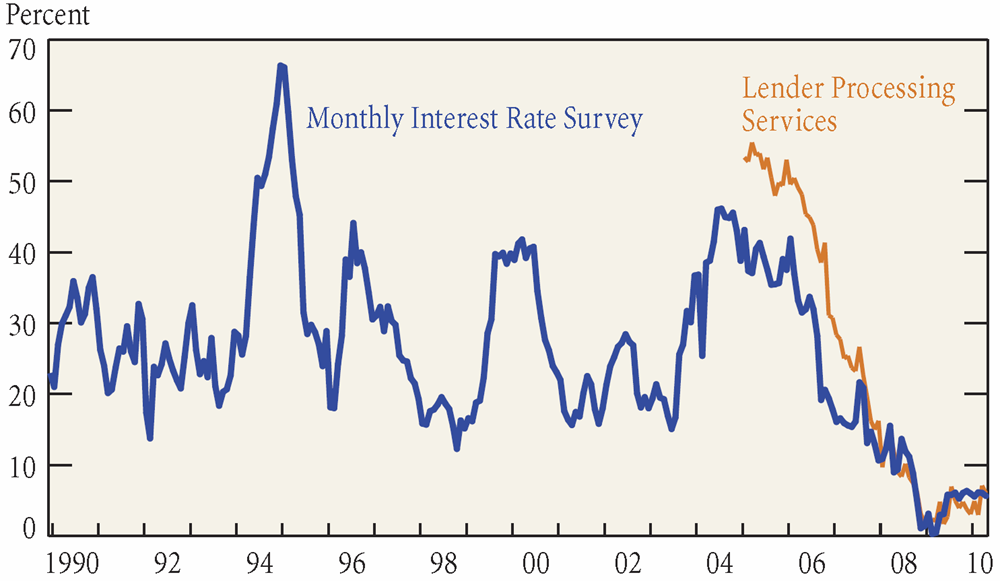

The direct talk on short-arm margin becomes louder during periods of frequent interest rate oscillation. Short-arm borrowers experience repayment effects sooner than those in long-term fixed loans. This sense of instability is often amplified when borrowers compare themselves with peers holding fixed-rate loans that appear insulated from market volatility.

Is the issue with short-ARM margin transparency or understanding?

Transparency vs Understanding

Nevertheless, it would not be fair to address such structures as deceptive. Borrowers sign on to margins at origination, but the real issue lies in understanding rather than transparency. Initial low rates often overshadow the long-term implications of the margin percentage rate.

Why can margin become a competitive constraint for lenders?

Margin as a Competitive Constraint

With the eyes of the lender, the short-arm margin is a hazard. If the margin is set too low then the loan might not yield enough profit margin for risk coverage. On the other side, if it is too high, then the loan will no longer be competitive in a crowded lending market. This is the reason for the commonality of low-margin clusters, despite the wide-ranging changes in index rates.

What role does the index rate play in ARM structures?

The Role of the Index Rate

The index rate also deserves attention. Common index rates include treasury yields and other benchmark rates tied to broader economic indicators. These indices are beyond the lender’s control, which is precisely why the margin exists. It allows lenders to separate revenue expectations from unpredictable market conditions.

Adjustable-Rate Mortgages (ARMs) Explained

How does short-ARM structure accelerate risk and reward?

Accelerated Risk and Reward

In short-arm mortgage agreements, the interaction between the variable index and the margin accelerates both risk and reward. Lenders benefit from faster repricing, while borrowers absorb interest rate volatility more quickly.

Is short-ARM margin opportunistic or structural?

Structural Nature of Short-ARM Margin

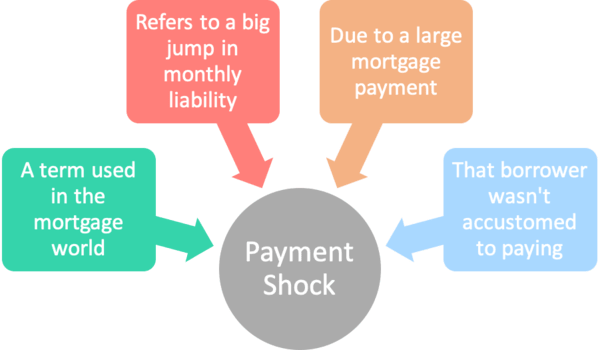

That is why short-arm margin is not an opportunistic feature but a structural one. It is designed to deliver consistent returns across market cycles rather than extract excess profit in short periods. For borrowers, however, the experience is often psychological, especially when payments rise sharply after the fixed period ends.

How do timing and exit strategies affect borrower outcomes?

Timing and Exit Strategies

Adjustable Rate Mortgages may appear attractive due to low initial interest rates, but long-term outcomes depend on how the margin interacts with future index movements. Borrowers who refinance or sell early may avoid much of the margin’s impact. Those who stay longer experience the full mechanics of the adjustable rate structure.

Why does the short-ARM margin debate persist?

Why the Debate Persists

This dynamic is what keeps short-arm margin controversial. It creates stable revenue for lenders while placing timing risk on borrowers—and that effect intensifies as the ARM duration shortens.